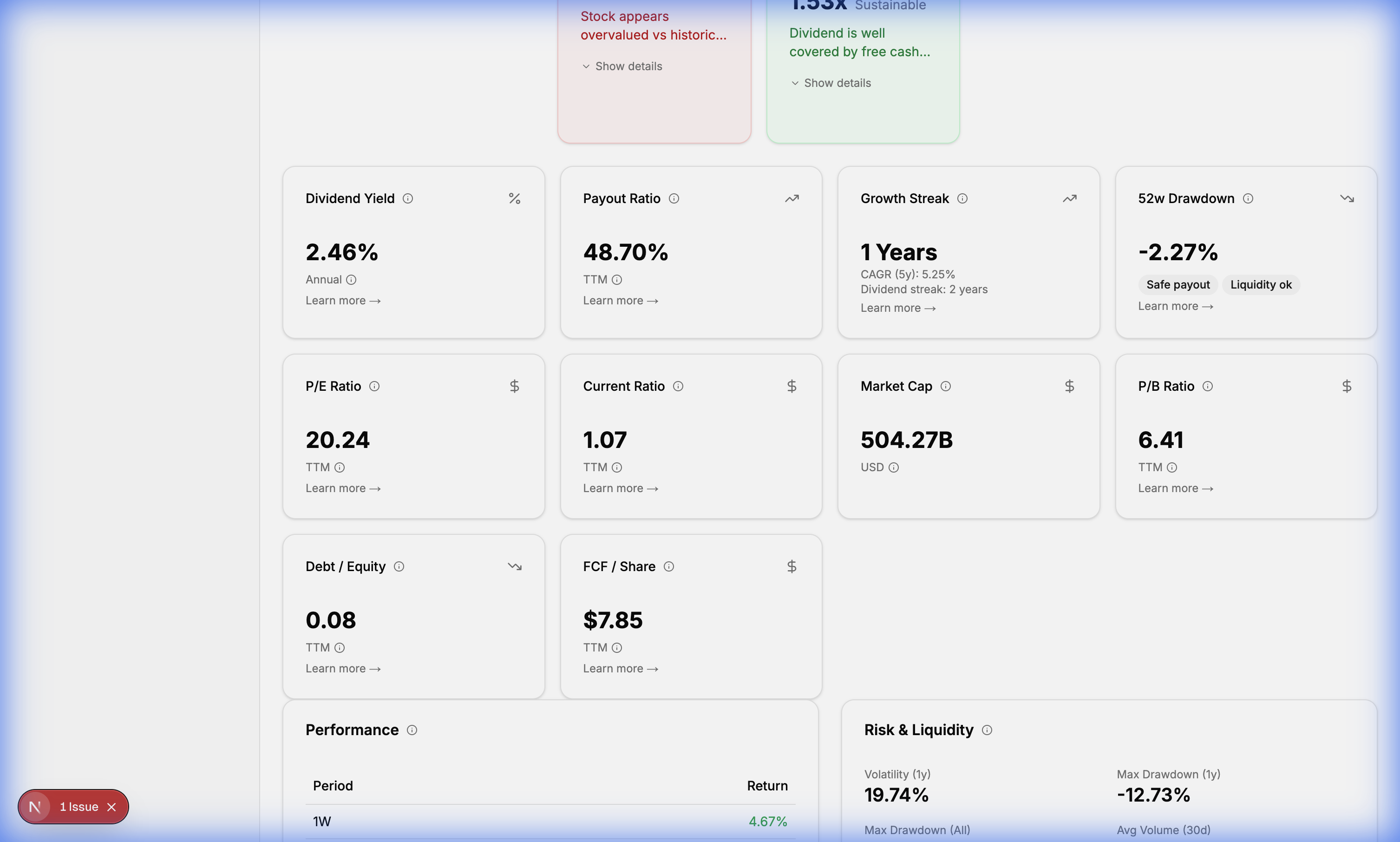

52-Week Drawdown

52-week drawdown measures how far a stock has fallen from its 52-week high. A -20% drawdown means the stock is 20% below its peak.

The Formula

Drawdown = ((Current Price - 52-Week High) ÷ 52-Week High) × 100

Why Dividend Investors Care

When quality dividend stocks experience significant drawdowns without cutting their dividend, it creates buying opportunities:

- Same dividend at a lower price = higher yield

- Quality companies often recover

- Dollar-cost averaging works in your favor

How Dividend.Direct Uses It

Drawdown contributes to our Value Score. Stocks with >20% drawdown and maintained dividends are flagged as potential opportunities.

See It in Action

Drawdown data helps identify potential value plays when quality stocks dip in price.