Understanding Payout Ratio

Payout ratio is the percentage of a company's earnings paid out as dividends. It measures how much of profits go to shareholders versus being reinvested.

The Formula

Payout Ratio = (Dividends per Share ÷ Earnings per Share) × 100

What Is a Safe Payout Ratio?

- <50%: Very safe - plenty of room for growth and downturns

- 50-70%: Moderate - healthy for mature companies

- 70-90%: Elevated - less room for error

- >90%: High risk - dividend may be cut if earnings drop

Exceptions

REITs and MLPs often have payout ratios above 90% by design - they're required to distribute most income. For these, check FCF payout coverage instead.

How Dividend.Direct Uses It

Payout ratio is a key component of our Quality Score. Stocks with ratios above 90% receive warning flags and lower scores.

See It in Action

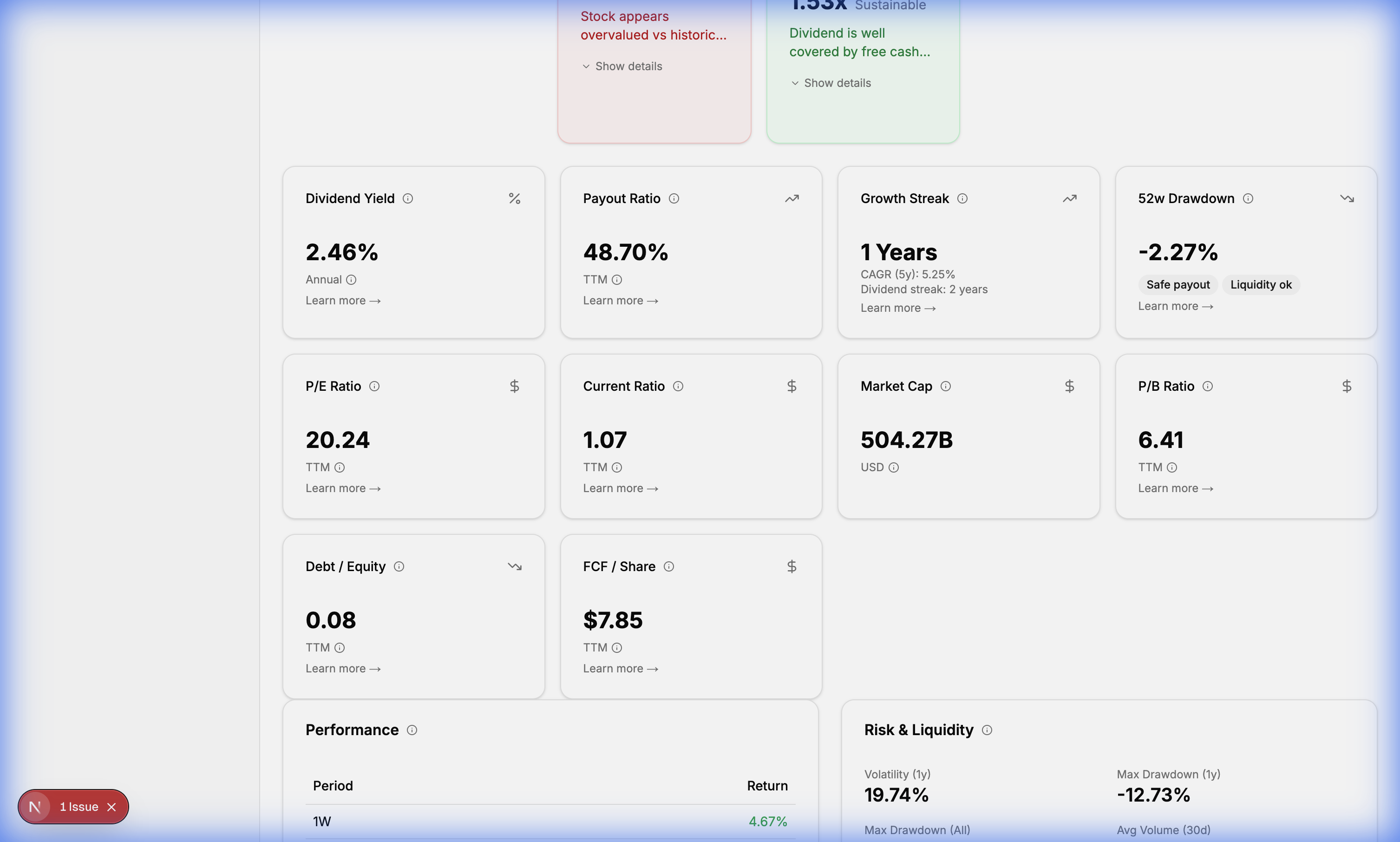

The Payout Ratio is displayed alongside yield and growth metrics to provide context on dividend safety.